Game-Changer: TSMC May Build Dedicated Apple Fab

An Apple/TSMC Deal Makes Sense -- But Disrupts Everybody Else

From Apple's perspective, a deal like this makes a tremendous amount of sense. Apple and Samsung clearly haven't mended their fences; the enmity between the two companies' is high enough that we're surprised they haven't broken manufacturing ties already. The Cupertino-based company can easily afford a massive investment in TSMC, particularly when said cash would buy access to a next-generation process node and a production guarantee. Apple has a long history as an early adopter of technology and strongly prefers to launch products based on that perception.

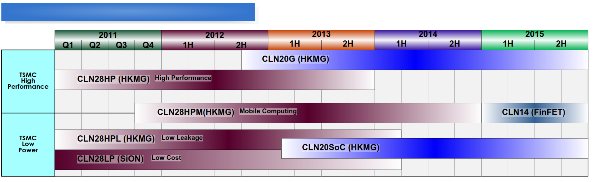

As for TSMC, an agreement of this sort would win it additional capital for investment and possibly accelerate its node deployments. Investors are clearly concerned about the amount of money the company spends on capital expenditures, and while Chang handled the questions adroitly, the foundry plans to introduce FinFET designs at 16nm and EUV at the 10nm node. Both of these technologies are significant changes that could prove difficult to adopt -- EUV (Extreme UltraViolet lithography) remains deeply problematic even after years of research.

Prioritizing Apple Would Change Everything

For everyone else who uses TSMC, this type of arrangement between the foundry and Apple would be an ugly kick in the guts. TSMC would undoubtedly try to downplay the impact of sudden demotion to second-string by offering more attractive terms or by claiming that Apple's investment would allow the company to accelerate deployment to such a degree that the impact would be negligible. Such arguments are unlikely to fly far given the current state of competition, in which Qualcomm, Samsung, Texas Instruments, and a number of other companies are fighting Apple tooth-and-nail.

Ultimately, TSMC's biggest customers may find themselves short of options. Moving designs from one foundry to another takes a considerable amount of time and effort might not solve the problem. If a combined TSMC+Apple definitively pulls ahead of GlobalFoundries on node deployments, opting for the latter would do Qualcomm little good. All the same, there have been rumors of shifting partnerships in the foundry world for months -- Qualcomm has reportedly tapped GlobalFoundries for future 28nm designs, Nvidia and Samsung may be working on a Tegra device, and AMD apparently settled on GloFo for its 28nm follow-up to Trinity, codenamed Kaveri. Kabini -- the 28nm follow-up to Brazos -- is less certain.

Rumors and questions about what Apple might do with its record-setting cash reserves have floated for months, and an investment of this sort could be one of the best ways the company could put those assets to work. It fits the company's ruthless competitive nature, its desire for a technological edge, and its emphasis on guaranteed availability. It's the exact opposite of the equal access arrangement the foundry model supposedly enabled, but for companies trying to catch Intel's manufacturing lead, it may be the only way to do so.

Don't expect any announcements in the next week, or even next month -- Apple is notoriously secretive, and TSMC will want to float this idea slowly, with probable implementation at the 20nm node rather than the current 28. Don't be surprised, however, if the number of companies exploring partnerships with non-traditional partners continues to rise. In today's cutthroat market, the risk of being 3-6 months behind Apple at a given node are too high for most companies to take -- even if the offer comes with lower costs and better yields.

As for TSMC, an agreement of this sort would win it additional capital for investment and possibly accelerate its node deployments. Investors are clearly concerned about the amount of money the company spends on capital expenditures, and while Chang handled the questions adroitly, the foundry plans to introduce FinFET designs at 16nm and EUV at the 10nm node. Both of these technologies are significant changes that could prove difficult to adopt -- EUV (Extreme UltraViolet lithography) remains deeply problematic even after years of research.

Prioritizing Apple Would Change Everything

For everyone else who uses TSMC, this type of arrangement between the foundry and Apple would be an ugly kick in the guts. TSMC would undoubtedly try to downplay the impact of sudden demotion to second-string by offering more attractive terms or by claiming that Apple's investment would allow the company to accelerate deployment to such a degree that the impact would be negligible. Such arguments are unlikely to fly far given the current state of competition, in which Qualcomm, Samsung, Texas Instruments, and a number of other companies are fighting Apple tooth-and-nail.

Ultimately, TSMC's biggest customers may find themselves short of options. Moving designs from one foundry to another takes a considerable amount of time and effort might not solve the problem. If a combined TSMC+Apple definitively pulls ahead of GlobalFoundries on node deployments, opting for the latter would do Qualcomm little good. All the same, there have been rumors of shifting partnerships in the foundry world for months -- Qualcomm has reportedly tapped GlobalFoundries for future 28nm designs, Nvidia and Samsung may be working on a Tegra device, and AMD apparently settled on GloFo for its 28nm follow-up to Trinity, codenamed Kaveri. Kabini -- the 28nm follow-up to Brazos -- is less certain.

Rumors and questions about what Apple might do with its record-setting cash reserves have floated for months, and an investment of this sort could be one of the best ways the company could put those assets to work. It fits the company's ruthless competitive nature, its desire for a technological edge, and its emphasis on guaranteed availability. It's the exact opposite of the equal access arrangement the foundry model supposedly enabled, but for companies trying to catch Intel's manufacturing lead, it may be the only way to do so.

Don't expect any announcements in the next week, or even next month -- Apple is notoriously secretive, and TSMC will want to float this idea slowly, with probable implementation at the 20nm node rather than the current 28. Don't be surprised, however, if the number of companies exploring partnerships with non-traditional partners continues to rise. In today's cutthroat market, the risk of being 3-6 months behind Apple at a given node are too high for most companies to take -- even if the offer comes with lower costs and better yields.