Samsung Investing In 40nm DRAM Technology

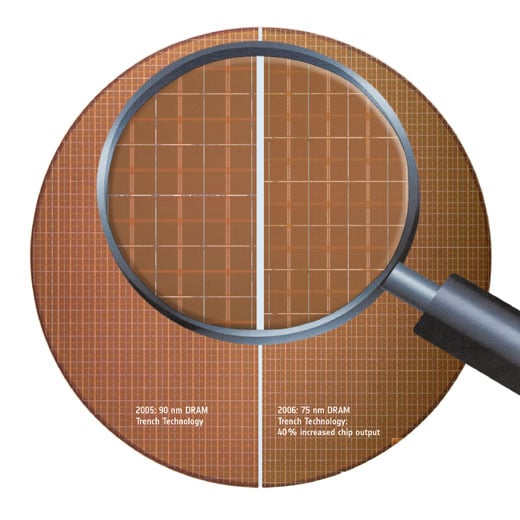

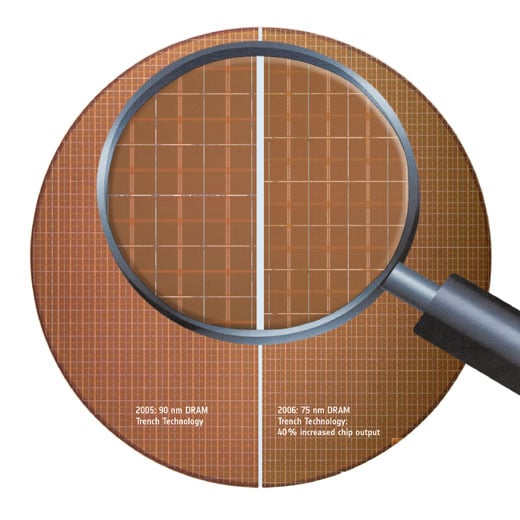

If recent technology news is any indication, Samsung has taken the concept of spending innovating one's way out of a recession and is running with the ball for all it's worth. We discussed the company's plans to move ahead with 450mm wafer production a few days ago; news today indicates the electronics manufacturer will invest $790 million into upgrading its DRAM production facilities in the second half of this year. Samsung believes the shift to a smaller process technology will improve production productivity (dies-per-wafer) by up to 60 percent, assuming equal yields. That cost savings eventually gets passed on to consumers, while the smaller process should theoretically allow for cooler, lower-voltage memory. The chips will also be denser, at 2Gb each compared to the 1Gb packages commonly in use today.

In many ways, this is business as usual. If you've ever followed the adoption of a memory standard, you've seen how the product changes as costs drop and companies improve their manufacturing techniques. RAM densities that once required two full banks shrink to just one side of the board, introductory voltages drop, and motherboard compatibility improves. In this case, Samsung isn't just investing money into DRAM manufacturing during an economic downturn, they're investing at a time when the DRAM industry is taking the pounding of its life. At present, the DRAM industry is overbuilt and under-margin, with chips selling for less than their cost of production. The major DRAM manufacturers have lost some 17 billion or more (the number keeps rising) in the past 18 months; losses in the first quarter alone topped one billion dollars. Multiple manufacturers are betting increased demand for DDR3 will allow them to raise prices, with one estimate projecting a 30 percent rise by the end of the year. Whether that estimate is based in anything more than wishful thinking, however, is very much open to debate.

Earlier today we covered the PC industry's performance in Q2, and noted that strong growth in the netbook/notebook market didn't necessarily offset the loss of revenue in other areas. Declining sales in the server/workstation market translates directly into tougher times for DRAM manufacturers, despite the fact that the market is much smaller. For a simple example, look no further than Dell's own website. Moving from 2GB to 4GB of DDR2-800 costs just $45 when we're talking about a basic Inspiron 531 desktop, or about $22.50 a gigabyte. If you want to fully load a Dell T710 server, on the other hand, that additional 180GB of DDR3 will set you back $55,620 or $309 per GB. Maxing out a Dell Precision T7500 is even more expensive, with 190GB of RAM going for a whopping $190,080 ($1,042 per GB).

Yes, these are maximum values and you can be sure Dell is packing away a hefty chunk of that profit, but it's easy to see how the DRAM industry depends heavily on product sales at the upper end of the PC market Worse, the consumer-oriented portables that are driving sales right now typically pack just 512MB-1GB of 400-533MHz DDR2. There's literally no profit in those chips. Samsung is obviously betting that the PC industry will embrace DDR3, and there's no doubt that sales will jump once Intel's mainstream Core i5 platform launches. Nonetheless, this is something of a gambit as far as the DRAM industry is concerned—it wouldn't be surprising if Samsung wound up focusing more on 40nm Flash and less on memory.

In many ways, this is business as usual. If you've ever followed the adoption of a memory standard, you've seen how the product changes as costs drop and companies improve their manufacturing techniques. RAM densities that once required two full banks shrink to just one side of the board, introductory voltages drop, and motherboard compatibility improves. In this case, Samsung isn't just investing money into DRAM manufacturing during an economic downturn, they're investing at a time when the DRAM industry is taking the pounding of its life. At present, the DRAM industry is overbuilt and under-margin, with chips selling for less than their cost of production. The major DRAM manufacturers have lost some 17 billion or more (the number keeps rising) in the past 18 months; losses in the first quarter alone topped one billion dollars. Multiple manufacturers are betting increased demand for DDR3 will allow them to raise prices, with one estimate projecting a 30 percent rise by the end of the year. Whether that estimate is based in anything more than wishful thinking, however, is very much open to debate.

Yes, these are maximum values and you can be sure Dell is packing away a hefty chunk of that profit, but it's easy to see how the DRAM industry depends heavily on product sales at the upper end of the PC market Worse, the consumer-oriented portables that are driving sales right now typically pack just 512MB-1GB of 400-533MHz DDR2. There's literally no profit in those chips. Samsung is obviously betting that the PC industry will embrace DDR3, and there's no doubt that sales will jump once Intel's mainstream Core i5 platform launches. Nonetheless, this is something of a gambit as far as the DRAM industry is concerned—it wouldn't be surprising if Samsung wound up focusing more on 40nm Flash and less on memory.