AMD Predicted To Further Chip Away At Intel Server CPU Market Share With EPYC Through 2020

AMD's rise back to prominence in the high-end CPU space has been partly (wait for it)...EPYC. That of course refers to AMD's efforts on the server side of the equation, where its EPYC processors are posing a formidable challenge to rival Intel's stronghold on the market. Little by little, however, AMD has been chipping away at Intel's dominance in the server sector, and that is likely to continue through at least 2020.

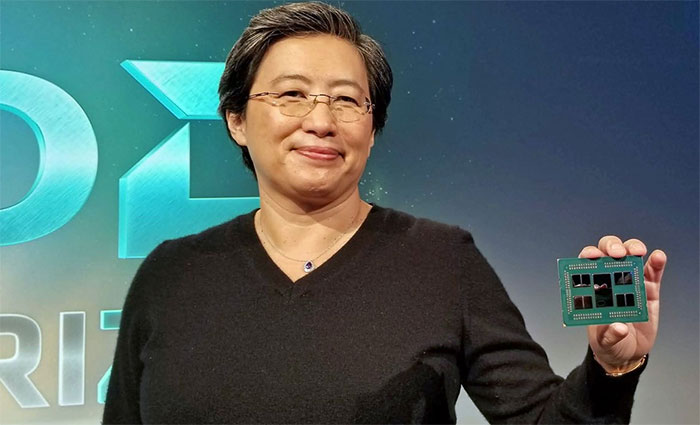

That's because somewhere around the bend lurks AMD's EPYC "Rome" refresh. As with everything else, EPYC is making a transition to a 7-nanometer manufacturing process, and as it applies to Rome, AMD recently previewed an unreleased 64-core/128-thread EPYC processor beating an pair of Intel Xeon Platinum 8180M CPUs in the C-Ray benchmark.

Obviously we would expect that to be the case, given the core- and thread-count advantages of AMD's part, but that is also the point—it is impressive that AMD crammed so many cores and threads into a single socket while offering comparable performance per core.

It also underscores that AMD is building capable solutions across the board. Last summer, AMD posted its best quarterly earnings results in 7 years, due in part to EPYC. And in its most recent quarterly earnings report, AMD met expectations with strong Ryzen and EPYC sales contributing to $1.42 billion in sales.

So it's no surprise when Digitimes says it is hearing from unnamed market sources that AMD will continue to receive more orders from server vendors and cloud service providers, at the expense of Intel. As such, Intel's market share in the server space is predicted to dip below 10 percent by the end of next year.

AMD has two things going for it with regards to EPYC. One is its upcoming refresh to 7nm, and the other is its aggressive price to performance ratio. Just as it does in the consumer space with Ryzen (and Threadripper), AMD offers a solid bang-for-buck proposition with EPYC in the server market. It was even reported last quarter that Intel started offering "significant discounts" to server customers to compete with AMD.

It is also worth noting that customers do not have to necessarily pick one or the other. According to recent data by Spiceworks, a professional network for the information technology (IT) industry, 16 percent of organizations uses AMD hardware, compared to 93 percent that use Intel hardware. What's more, the firm found that 5 percent of businesses are expected to add AMD server hardware within the next two years, and that number climbs to 8 percent if looking at two years and beyond.

AMD finds itself in a good place, and just as importantly, it looks as though it has the pieces in place to keep the momentum going.