AMD Rumored To Announce Layoffs, New Hardware, ARM Servers On Monday

After its conference call last week, AMD is jonesing for some positive news to toss investors and is planning a major announcement on Monday to that effect. Rumor suggests that a number of statements may be coming down the pipe, including the scope of the company's layoffs, new parts based on Piledriver Opterons, and possibly an ARM server announcement.

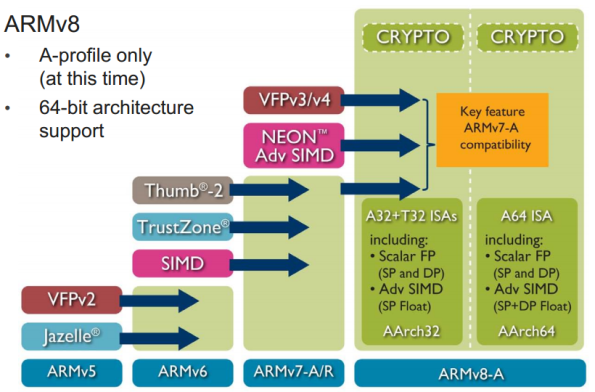

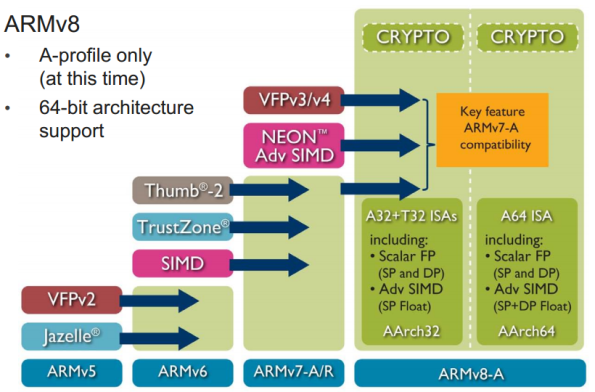

The latter would be courtesy of AMD's investment in SeaMicro. SeaMicro built its business on ultra-low power servers, and the first 64-bit ARMv8 silicon is expected in the very near future, but there's always a significant lag between chip announcements and actual shipping products. Even if AMD announces Monday, it'd be surprising to see a core debut before the middle of next year.

Buying SeaMicro gives AMD a leg up on actually getting an ARM chip into shipping boxes and announcing such a move could bolster investor confidence that AMD has plans for something other than being driven out of business by Intel. The problem there is, it could also lead to fears that AMD is taking its eye off a proven technology (x86) to chase unproven assets (ARM) against competitors that know the market far better.

There's also the fact that ARM servers are currently a paper fiction dreamed up by analysts and journalists. Sure, there's been some high-powered announcement and investment. It's logical to think the market is going to trend this way, and that ARM is going to grab a chunk of the server market. What no one knows is what that market is going to look like, how big it'll be, or why AMD would go chasing ARMv8 fairies when Kabini, the follow-up to Brazos, is supposedly on track for an introduction in 1H 2013.

Still, if AMD could build momentum around an ARM part, it'd help give the company a backstop. No matter where it comes from, Sunnyvale needs a product segment it can stand on, an area that gives it a solid footing to push back and buy time.

In other news, Fitch Ratings announced today that its cut AMD's unsecured senior debt rating to B/RR4 from B+/RR3. The agency notes that it expects "strong double-digit negative revenue growth through 2013," expects gross margin to remain below 40%, and believes AMD could finish 2013 close to $700-800 million in cash that's needed to continue operating. At present, AMD has ~$1.1B in cash on hand. The firm is also concerned about AMD's job cuts, and believes the company may be about to throw away the assets it needs to save itself.

We'll know more on Monday.

The latter would be courtesy of AMD's investment in SeaMicro. SeaMicro built its business on ultra-low power servers, and the first 64-bit ARMv8 silicon is expected in the very near future, but there's always a significant lag between chip announcements and actual shipping products. Even if AMD announces Monday, it'd be surprising to see a core debut before the middle of next year.

Buying SeaMicro gives AMD a leg up on actually getting an ARM chip into shipping boxes and announcing such a move could bolster investor confidence that AMD has plans for something other than being driven out of business by Intel. The problem there is, it could also lead to fears that AMD is taking its eye off a proven technology (x86) to chase unproven assets (ARM) against competitors that know the market far better.

There's also the fact that ARM servers are currently a paper fiction dreamed up by analysts and journalists. Sure, there's been some high-powered announcement and investment. It's logical to think the market is going to trend this way, and that ARM is going to grab a chunk of the server market. What no one knows is what that market is going to look like, how big it'll be, or why AMD would go chasing ARMv8 fairies when Kabini, the follow-up to Brazos, is supposedly on track for an introduction in 1H 2013.

Still, if AMD could build momentum around an ARM part, it'd help give the company a backstop. No matter where it comes from, Sunnyvale needs a product segment it can stand on, an area that gives it a solid footing to push back and buy time.

In other news, Fitch Ratings announced today that its cut AMD's unsecured senior debt rating to B/RR4 from B+/RR3. The agency notes that it expects "strong double-digit negative revenue growth through 2013," expects gross margin to remain below 40%, and believes AMD could finish 2013 close to $700-800 million in cash that's needed to continue operating. At present, AMD has ~$1.1B in cash on hand. The firm is also concerned about AMD's job cuts, and believes the company may be about to throw away the assets it needs to save itself.

We'll know more on Monday.