Is Unprofitable Yelp Ready for their $100 Million IPO?

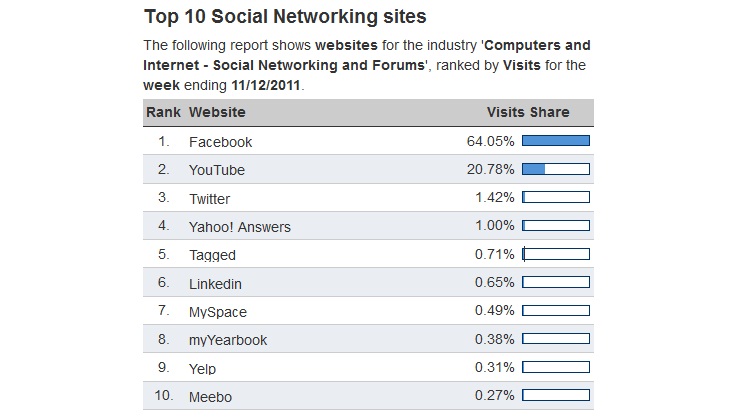

There's nothing better than traffic when trying to prove a website's worth and Yelp is starting to show some serious gains as they prepare for their initial public offering. The user-generated review site made it into Hitwise's top 10 Social Networks list the week before they filed for an IPO of up to $100 million.

Are they ready? They aren't turning a profit, yet, with losses of $7.4 million in the first 3 quarters of 2011. Traffic is up 63% over last year with 61 million monthly visitors, but they are still behind other less-known social sites like myYearbook and Tagged.com in terms of pure visits. Some critics are pointing to their reliance on Google traffic as a flaw in their business model.

The biggest problem for Yelp is that they are not self-sustainable. It isn't just Google. Yelp is forced to rely on mobile apps, search engines, and social media sites like Facebook and Twitter to keep their traffic growing. Unlike other anticipated IPOs for social companies such as Facebook and Groupon, Yelp cannot stand alone. Other companies such as Zynga also rely on the symbiotic relationships they hold with Facebook and others, but Zynga has reached a tipping point that would allow them to stand alone even if major changes happened on their current venues. More importantly, they're profitable ahead of their IPO.

Yelp needs help and in many ways must allow others to control their future. To make things more precarious, Yelp has shown a willingness to fight with bigger companies such as Google despite having a deep reliance on them. Google is pressing hard for Google Places to continue to grow and integrate with Google+ and even purchased restaurant-review specialists Zagat. 23% of Yelp's 22 million reviews are on restaurants.

Facebook has an on-again, off-again opinion about reviews and business listings but will likely push forward to try to be the social sharing centerpiece for everything personal- and business-related. Smaller sites continue to try to catch the review wave as consumers migrate away from "experts" and rely on user-generated reviews.

Yelp has a good potential for a bright future. They seem to be an ideal moderate risk for venture capital, but are there too many landmines in front of them that make them a bad candidate for going public. They have a few months to prepare, but without major changes and a sustainable revenue model, they don't seem like the safest bet.