Mixed Baggage: AOL Struggles Forward

It's been a few months since we covered AOL's controversial new business strategy and surprising purchase of The Huffington Post. The company released its first quarter results earlier this week—is there any good news underneath the bad?

A little, as it turns out. Global display advertising revenue (this refers to large, flashy ads) grew four percent quarter-on-quarter, marking the first increase in display revenue since Q4 2007. Company chairman Tim Armstrong stated: ""Today represents an important milestone in the turnaround of AOL as global display revenue grew for the first time since Q4 2007. I am proud of the work completed thus far and we remain focused on accelerating our momentum through continued execution of our strategy to become the premier digital content company."

Domestic display revenue actually grew more (by approximately 11 percent), but the company's subscriber revenues fell 22 percent year on year. It's not clear if this translates to a 22 percent loss in subscribers, or if users who formally paid for AOL now access its features for free. We suspect the decline might be related to earlier statements that indicated the company depends on the uninformed for the majority of its revenue.

Investors sent the stock ticking higher on the wake of these results. Clayton Moran, with Benchmark Co, called it "the first encouraging quarter since the Time Warner spin." and "the first evidence they might be able to achieve a turnaround in the advertising business."

Current thinking is that recent acquisitions like TechCrunch and HuffPo have given AOL's financials a boost, but neither portal is large enough to lift the once-mighty behemoth on its own. Indeed, some investors damned the company's results with faint praise. "I like these AOL numbers," said Laura Martin, an analyst with Needham & Co. "I like the fact that (subscription) churn is lower. It really says the deterioration is slowing it will hold up earnings longer."

AOL still faces enormous revenue problems—the small growth in display advertising is nowhere near enough to compensate for continuing losses in search, subscriptions, other forms of advertising, and the significant restructuring costs it's incurred while trying to stay afloat. The HuffPo purchase was a daring move, but it's too soon to tell if Arianna Huffington will be able to turn the situation around.

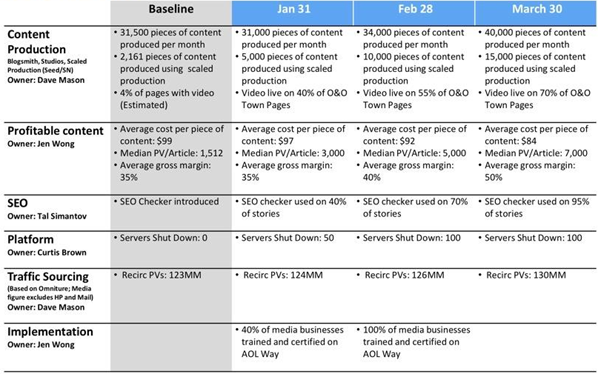

We're not yet convinced that AOL is dedicated to producing the type of top-quality content that would grant it a seat at the top of the digital totem pole. AOL's last reorganization plan—only a few months old—makes no bones about the fact that it prefers quantity over quality, and lots of it. Online news aggregators and blogs publish much more quickly than their paper-based ancestors did once upon a time, but AOL may be doing little more than funding short-term growth at the expense of long-term readers. There's some precedent—it's what the company has done almost since its birth.

A little, as it turns out. Global display advertising revenue (this refers to large, flashy ads) grew four percent quarter-on-quarter, marking the first increase in display revenue since Q4 2007. Company chairman Tim Armstrong stated: ""Today represents an important milestone in the turnaround of AOL as global display revenue grew for the first time since Q4 2007. I am proud of the work completed thus far and we remain focused on accelerating our momentum through continued execution of our strategy to become the premier digital content company."

Domestic display revenue actually grew more (by approximately 11 percent), but the company's subscriber revenues fell 22 percent year on year. It's not clear if this translates to a 22 percent loss in subscribers, or if users who formally paid for AOL now access its features for free. We suspect the decline might be related to earlier statements that indicated the company depends on the uninformed for the majority of its revenue.

Investors sent the stock ticking higher on the wake of these results. Clayton Moran, with Benchmark Co, called it "the first encouraging quarter since the Time Warner spin." and "the first evidence they might be able to achieve a turnaround in the advertising business."

Current thinking is that recent acquisitions like TechCrunch and HuffPo have given AOL's financials a boost, but neither portal is large enough to lift the once-mighty behemoth on its own. Indeed, some investors damned the company's results with faint praise. "I like these AOL numbers," said Laura Martin, an analyst with Needham & Co. "I like the fact that (subscription) churn is lower. It really says the deterioration is slowing it will hold up earnings longer."

AOL still faces enormous revenue problems—the small growth in display advertising is nowhere near enough to compensate for continuing losses in search, subscriptions, other forms of advertising, and the significant restructuring costs it's incurred while trying to stay afloat. The HuffPo purchase was a daring move, but it's too soon to tell if Arianna Huffington will be able to turn the situation around.

We're not yet convinced that AOL is dedicated to producing the type of top-quality content that would grant it a seat at the top of the digital totem pole. AOL's last reorganization plan—only a few months old—makes no bones about the fact that it prefers quantity over quality, and lots of it. Online news aggregators and blogs publish much more quickly than their paper-based ancestors did once upon a time, but AOL may be doing little more than funding short-term growth at the expense of long-term readers. There's some precedent—it's what the company has done almost since its birth.