Gartner Reports North American PC Sales Down 5.9% In Q4 2011

Weak consumer demand and a limited impact from the Thailand floods in the last part of the year drove PC sales down significantly in the US, while the global market saw a smaller 1.4 percent decline. The impact of the HDD shortage is expected to bite partly in Q1; while the floods hit in Q4, most manufacturers had sufficient inventory levels to see them through much of the end of the year.

“Continuously low consumer PC demand resulted in weak holiday PC shipments,” said Mikako Kitagawa, principal analyst at Gartner. “While economic uncertainty in Western Europe had an effect on consumer PC shipments, expectations of a healthier economic outlook in North America could not stimulate consumer PC demand in that region. The healthy professional PC market as well as growth in emerging markets could not compensate for the weaknesses in mature markets, with overall growth still negative."

Ultrabooks, meanwhile, went nowhere fast. "Ultrabooks were quietly introduced into the market during the 4Q11 holiday season,” Ms. Kitagawa said. “Ultrabooks didn’t seem to draw consumers’ attention. Consumers had very little understanding and awareness of ultrabooks, and only a small group of consumers was willing to pay the price premium for such models. However, as has been seen this week at the International Consumer Electronics Show (CES) show, 2012 is a big debut stage for ultrabooks.”

Ultrabooks were a major force on the show floor this year, but they also shared a great deal of space with tablets and smartphone announcements. The product segments don't overlap much, if at all, but consumers and reporters at the show can only take in (and write up) so much. Ultrabooks may make more sense to consumers, particularly once Intel starts flogging Ivy Bridge, or they may have gotten lost in the shuffle.

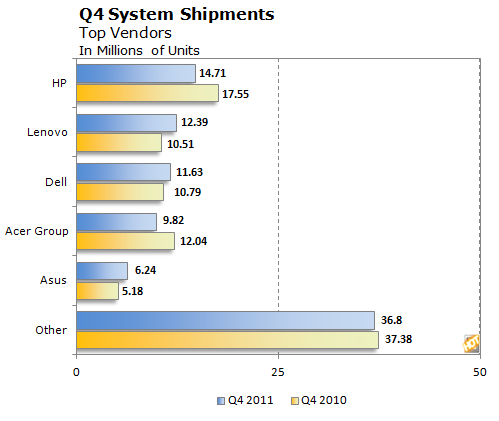

Here's the numbers for the US market for Q4 2011 vs. Q4 2010.

Ow. HP is easily the biggest loser here in terms of dollar amounts; Gartner believes the company's tumble is mostly thanks to onetime CEO Lee Apotheker's decision to openly consider dumping HP's core PC business. The company's board dumped Apotheker for current CEO Meg Whitman, but the damage was done. Dell and Lenovo profited from HP's loss, and picked up a considerable amount of business over the same period.

Acer made waves earlier this year when it fired and replaced its own CEO in a bid to transform the company into more of an Apple competitor. While it demo'd a number of interesting products at CES 2012, the company's Q4 sales slumped over 18 percent year on year. The company's quest to compete with the likes of Apple and HTC is off to a slow start.

Asus, however, has reason to be smiling. Not only has the company's Transformer Prime reviewed well, total PC sales for Q4 rose 20.5 percent. Asus won its way into the top five by replacing Toshiba, which has fallen to #6.

“Continuously low consumer PC demand resulted in weak holiday PC shipments,” said Mikako Kitagawa, principal analyst at Gartner. “While economic uncertainty in Western Europe had an effect on consumer PC shipments, expectations of a healthier economic outlook in North America could not stimulate consumer PC demand in that region. The healthy professional PC market as well as growth in emerging markets could not compensate for the weaknesses in mature markets, with overall growth still negative."

Ultrabooks, meanwhile, went nowhere fast. "Ultrabooks were quietly introduced into the market during the 4Q11 holiday season,” Ms. Kitagawa said. “Ultrabooks didn’t seem to draw consumers’ attention. Consumers had very little understanding and awareness of ultrabooks, and only a small group of consumers was willing to pay the price premium for such models. However, as has been seen this week at the International Consumer Electronics Show (CES) show, 2012 is a big debut stage for ultrabooks.”

Ultrabooks were a major force on the show floor this year, but they also shared a great deal of space with tablets and smartphone announcements. The product segments don't overlap much, if at all, but consumers and reporters at the show can only take in (and write up) so much. Ultrabooks may make more sense to consumers, particularly once Intel starts flogging Ivy Bridge, or they may have gotten lost in the shuffle.

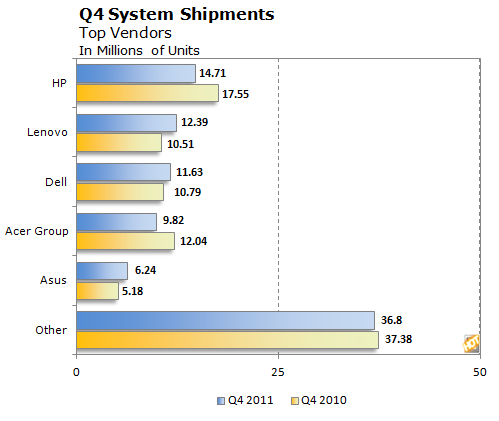

Here's the numbers for the US market for Q4 2011 vs. Q4 2010.

Ow. HP is easily the biggest loser here in terms of dollar amounts; Gartner believes the company's tumble is mostly thanks to onetime CEO Lee Apotheker's decision to openly consider dumping HP's core PC business. The company's board dumped Apotheker for current CEO Meg Whitman, but the damage was done. Dell and Lenovo profited from HP's loss, and picked up a considerable amount of business over the same period.

Acer made waves earlier this year when it fired and replaced its own CEO in a bid to transform the company into more of an Apple competitor. While it demo'd a number of interesting products at CES 2012, the company's Q4 sales slumped over 18 percent year on year. The company's quest to compete with the likes of Apple and HTC is off to a slow start.

Asus, however, has reason to be smiling. Not only has the company's Transformer Prime reviewed well, total PC sales for Q4 rose 20.5 percent. Asus won its way into the top five by replacing Toshiba, which has fallen to #6.