Intel Claims Asian Chip Manufacturers Will Flock To Its Tech For Mobile But Can They Deliver?

It has been over six years since Intel first unveiled its Atom CPUs and detailed its plans for new, ultra-mobile devices. The company's efforts to break into smartphone and tablet sales, while turning a profit, have largely come to naught. Nonetheless, company CEO Brian Krzanich remains optimistic. Speaking to reporters on Monday, Krzanich opined that the company's new manufacturing partners like Rockchip and Spreadtrum would convert entirely to Intel architectures within the next few years.

Krzanich has argued that with Qualcomm and MediaTek dominating the market, it's going to be tougher and tougher for little guys like Rockchip and Spreadtrum to compete in the same spaces. There's truth to that argument, to be sure, but Intel's ability to offer a competitive alternative is unproven. According to a report from JP Morgan, Intel's cost-per-wafer is currently estimated as equivalent to TSMC's average selling price per wafer -- meaning TSMC is making money well below Intel's break-even.

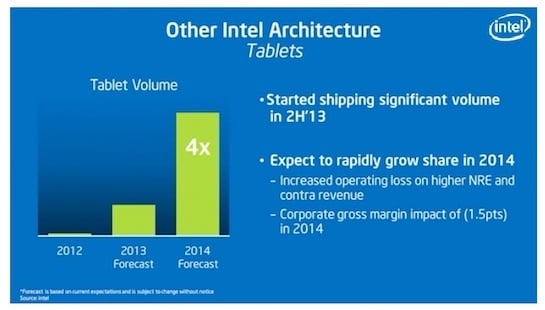

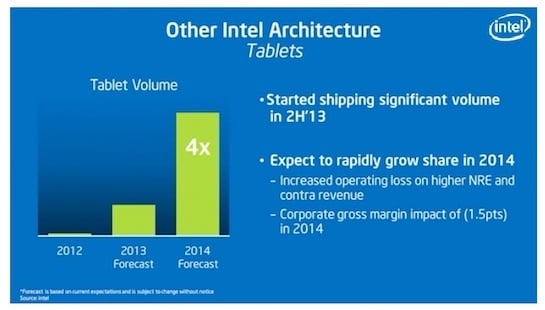

Intel, to be sure, has talked about its strategic realignment to build lower-cost parts. The company has been expanding its foundry business, and it cut a strategic deal with TSMC to manufacture a new Atom SoC (codenamed SoFIA) on its rival's process technology because it made sense to do so. Krzanich is clearly committed to making long-term changes that put Santa Clara in a position to compete in markets where it currently doesn't have much presence, and the cost optimization process is supposed to allow Intel's mobile division to turn a profit by 2016. At present, Intel ships its tablets "contra revenue," meaning it loses $1-2 billion a quarter on marketing funds or price rebates as a means of boosting demand.

Does Android need Intel?

When Intel first debuted Medfield in late 2011, it talked about the strengths it brought to the Android tablet market. At the time, the highest-end ARM chip available was the Cortex-A9. Dual-core processors were hot commodities, but Android software was rarely designed to multi-thread effectively. Dynamic voltage and frequency scaling (DVFS) was nonexistent. Low power options like big.LITTLE and Nvidia's Companion Core didn't exist yet in shipping hardware.

Intel promised that it would quickly introduce dual-core + Hyper-Threaded processors and bring its substantial software expertise over to a market which, at the time, was in need of a more sophisticated approach to multiple aspects of the mobile market.

Intel plans to release new variant of Bay Trail with cost-optimized components, quicker time to market.

At the time, this was a compelling argument. Today, Intel is unquestionably capable of building tablet processors that offer a good overall experience -- but the question of what defines a "good" experience is measured in its similarity to ARM. This is analogous to the PC market of the late 1990s, when systems with x86 CPUs built by Cyrix, VIA, AMD, and WinChip were all measured based on how closely they matched the performance of an Intel system.

Today, the ARM tablets that use chips from Rockchip or Spreadtrum often don't bother to list a manufacturer at all and simply identify themselves as a "Cortex-A9" or equivalent. It's hard to imagine that Intel wants to build market share as an invisible partner, but in order to fundamentally change the way people think about Intel hardware in tablets and smartphones, it needs to go beyond simply being "as good" and break into territory that leaves people asking: "Is the ARM core just as good as the Intel chip?"

It's hard to see how Intel can do that by partnering with OEMs that specialize in providing ultra-affordable hardware on older process nodes -- and the cost structures those companies require to be profitable could make that hard row even tougher to hoe. It's not really a question of whether Intel can build competitive hardware, but whether it can create a business opportunity for itself at price points and mind share that meet the company's own goals.

Krzanich has argued that with Qualcomm and MediaTek dominating the market, it's going to be tougher and tougher for little guys like Rockchip and Spreadtrum to compete in the same spaces. There's truth to that argument, to be sure, but Intel's ability to offer a competitive alternative is unproven. According to a report from JP Morgan, Intel's cost-per-wafer is currently estimated as equivalent to TSMC's average selling price per wafer -- meaning TSMC is making money well below Intel's break-even.

Intel, to be sure, has talked about its strategic realignment to build lower-cost parts. The company has been expanding its foundry business, and it cut a strategic deal with TSMC to manufacture a new Atom SoC (codenamed SoFIA) on its rival's process technology because it made sense to do so. Krzanich is clearly committed to making long-term changes that put Santa Clara in a position to compete in markets where it currently doesn't have much presence, and the cost optimization process is supposed to allow Intel's mobile division to turn a profit by 2016. At present, Intel ships its tablets "contra revenue," meaning it loses $1-2 billion a quarter on marketing funds or price rebates as a means of boosting demand.

Does Android need Intel?

When Intel first debuted Medfield in late 2011, it talked about the strengths it brought to the Android tablet market. At the time, the highest-end ARM chip available was the Cortex-A9. Dual-core processors were hot commodities, but Android software was rarely designed to multi-thread effectively. Dynamic voltage and frequency scaling (DVFS) was nonexistent. Low power options like big.LITTLE and Nvidia's Companion Core didn't exist yet in shipping hardware.

Intel promised that it would quickly introduce dual-core + Hyper-Threaded processors and bring its substantial software expertise over to a market which, at the time, was in need of a more sophisticated approach to multiple aspects of the mobile market.

Intel plans to release new variant of Bay Trail with cost-optimized components, quicker time to market.

At the time, this was a compelling argument. Today, Intel is unquestionably capable of building tablet processors that offer a good overall experience -- but the question of what defines a "good" experience is measured in its similarity to ARM. This is analogous to the PC market of the late 1990s, when systems with x86 CPUs built by Cyrix, VIA, AMD, and WinChip were all measured based on how closely they matched the performance of an Intel system.

Today, the ARM tablets that use chips from Rockchip or Spreadtrum often don't bother to list a manufacturer at all and simply identify themselves as a "Cortex-A9" or equivalent. It's hard to imagine that Intel wants to build market share as an invisible partner, but in order to fundamentally change the way people think about Intel hardware in tablets and smartphones, it needs to go beyond simply being "as good" and break into territory that leaves people asking: "Is the ARM core just as good as the Intel chip?"

It's hard to see how Intel can do that by partnering with OEMs that specialize in providing ultra-affordable hardware on older process nodes -- and the cost structures those companies require to be profitable could make that hard row even tougher to hoe. It's not really a question of whether Intel can build competitive hardware, but whether it can create a business opportunity for itself at price points and mind share that meet the company's own goals.